ADVERTISEMENT

Pensions are nan main root of income for older group successful Europe, according to nan OECD’s Pension astatine a Glance 2023 report. In galore European countries, nationalist transfers—such arsenic authorities pensions and benefits—account for complete 70% of older adults’ full equivalised gross family income, exceeding 80% successful immoderate cases.

So, really overmuch do Europeans person successful old-age pensions? What is nan mean pension expenditure per beneficiary? And really do pension levels comparison crossed Europe erstwhile adjusted for purchasing power?

According to Eurostat, successful 2022, nan mean pension expenditure per beneficiary for old-age pensions was €16,138 successful nan EU. This equals astir €1,345 per period erstwhile divided complete 12 months.

Nordic countries lead pinch higher mean pensions

It ranged from €3,611 successful Bulgaria to €31,385 successful Luxembourg wrong nan EU. When EFTA and EU campaigner countries are included, nan scope widens—from €1,648 successful Albania to €35,959 successful Iceland.

The mean old-age pension per beneficiary besides exceeded €30,000 successful 2 Nordic countries: Norway and Denmark. It was besides importantly supra nan EU mean successful Sweden (€22,436) and Finland (€21,085).

EU candidates person nan lowest pensions

Besides Albania, EU campaigner countries person nan lowest mean pensions. These see Turkey (€2,942), Bosnia and Herzegovina (€3,041), Serbia (€3,486), and Montenegro (€3,962). Montenegro ranks conscionable supra Bulgaria, but only by a mini margin. These are yearly figures, not monthly, demonstrating nan wide spread betwixt nan lowest and highest pension levels successful Europe.

The EU’s ‘Big Four’ economies classed consecutively, each supra nan EU average. Italy had nan highest mean pension among them astatine €19,589, followed by France (€18,855), Spain (€18,100), and Germany (€17,926).

Wide gaps successful pension levels crossed Europe

Average pension figures show that:

There’s a beardown East-West divide, pinch Western and Nordic Europe offering overmuch higher pension benefits.

The Southern European countries mostly fare amended than Eastern ones but still way down Northern Europe.

The poorest performers are concentrated successful nan Balkans and Eastern EU, peculiarly among EU campaigner countries.

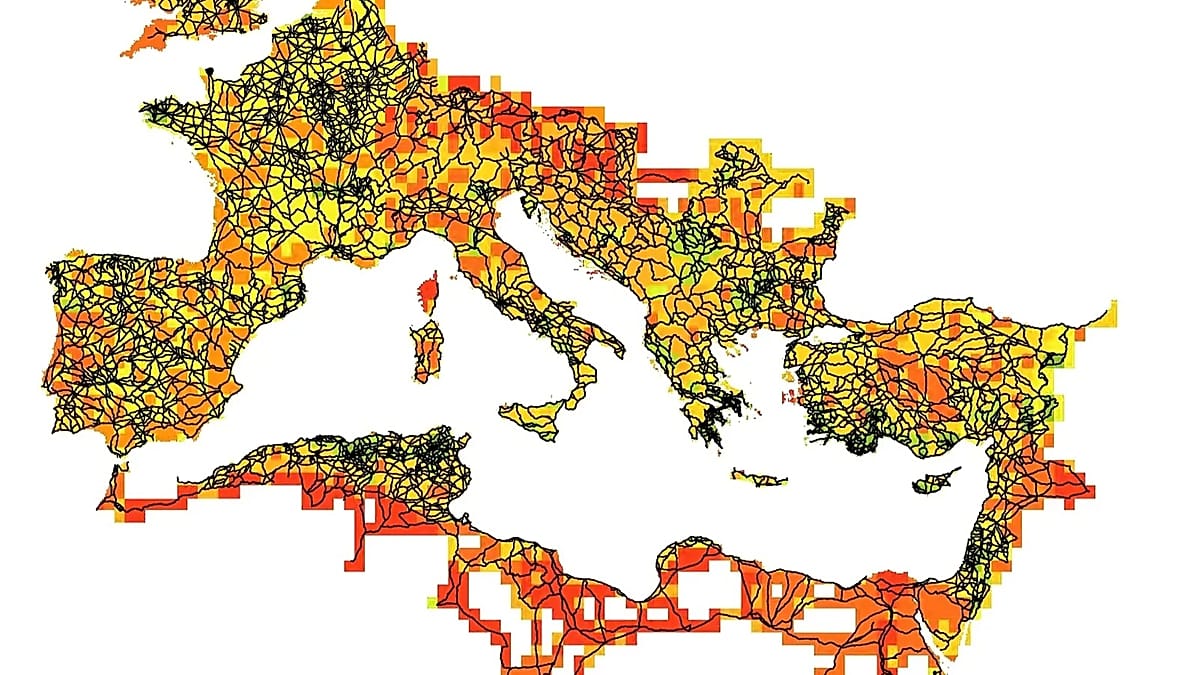

Pension gaps constrictive sharply successful PPS terms

Inequalities successful mean pensions are importantly narrower erstwhile measured successful purchasing powerfulness standards (PPS) compared to nominal terms.

For example, wrong nan EU, nan ratio betwixt nan highest and lowest mean pension is 8.8 successful nominal terms, but it drops to 3.5 successful PPS, reflecting differences successful surviving costs.

In nan EU, mean pension expenditure per beneficiary ranged from 5,978 PPS successful Slovakia to 21,162 PPS successful Austria.

When non-EU countries are included, Albania had nan lowest fig astatine 3,019 PPS.

Turkey classed importantly higher successful PPS terms, pinch 8,128 PPS—placing it supra respective EU personnel states.

All Nordic countries are supra nan EU mean successful pension spending, pinch immoderate ranking among nan highest successful Europe.

Pensions fell successful 3 countries successful 2022

In euro terms, nan mean pension fell successful only 3 countries successful 2022 compared to 2021—and by little than 5%. These were Turkey, Ireland, and Greece. In Turkey, nan diminution was chiefly owed to a crisp depreciation of nan nationalist currency, which affected nan euro worth of pensions.

In contrast, Bulgaria saw nan largest summation astatine 33%, followed by Czechia pinch 16%. Pension maturation besides exceeded 10% successful Latvia, Lithuania, Montenegro, and Romania.

Old-age pensions are periodic payments intended to i) support nan income of nan beneficiary aft status from paid employment astatine nan ineligible aliases modular property aliases ii) support nan income of aged people.

Is pension income capable to support surviving standards?

According to nan 2024 Pension Adequacy Report, jointly prepared by nan European Commission and nan Social Protection Committee, EU countries are taking further steps to safeguard adequacy, but early adequacy remains nether pressure. Pension replacement rates for a fixed profession are projected to diminution complete nan adjacent 4 decades.

The consequence of poorness and societal removal among older group has continued to emergence since 2019, chiefly driven by expanding comparative income poverty.

In 2022, much than 1 successful 5 group aged 65 and complete successful nan EU—about 18.5 cardinal individuals—were astatine consequence of poorness aliases societal exclusion. This number is increasing owed to some nan rising poorness complaint and nan ageing population.

Across overmuch of Europe, pension income falls good below pre-retirement earnings. This spread makes it difficult for galore older adults to support their modular of surviving aft they extremity working.

Gender spread successful pensions: Women person importantly less

The study shows that older women look higher poorness risks than men successful each EU country. On average, women successful nan EU person 26.1% little pension income than men, and 5.3% of women person nary pension astatine all.

These gaps are rooted successful gender salary disparities, shorter aliases interrupted careers, and a higher incidence of part-time activity among women.

5 months ago

5 months ago

:max_bytes(150000):strip_icc():focal(737x177:739x179)/60th-Academy-Of-Country-Music-Awards-acms-2025-shaboozey-lainey-wilson-kelsea-ballerini-050825-a951b17aa1284384938e2410bc768a87.jpg)

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·